STEVE REID

Editor & Publisher

sreid@lbknews.com

If you’ve looked at your property tax bill over the last decade, you might have noticed a confusing trend: the tax rate (millage) set by the Town of Longboat Key hasn’t changed much—in fact, it has gone down slightly. Yet, the check you write to the tax collector keeps getting bigger.

This is the “flat rate” illusion, a fiscal phenomenon that has allowed the Town of Longboat Key to increase its annual property tax revenue by millions of dollars without ever having to announce a “tax rate increase.”

By keeping the millage rate steady while property values skyrocket, the Town has effectively collected a “hidden” tax hike year after year. A deep dive into the last 10 years of financial data reveals exactly how this mechanism works—and how much it has added to the town’s coffers.

The Numbers: A Decade of Growth

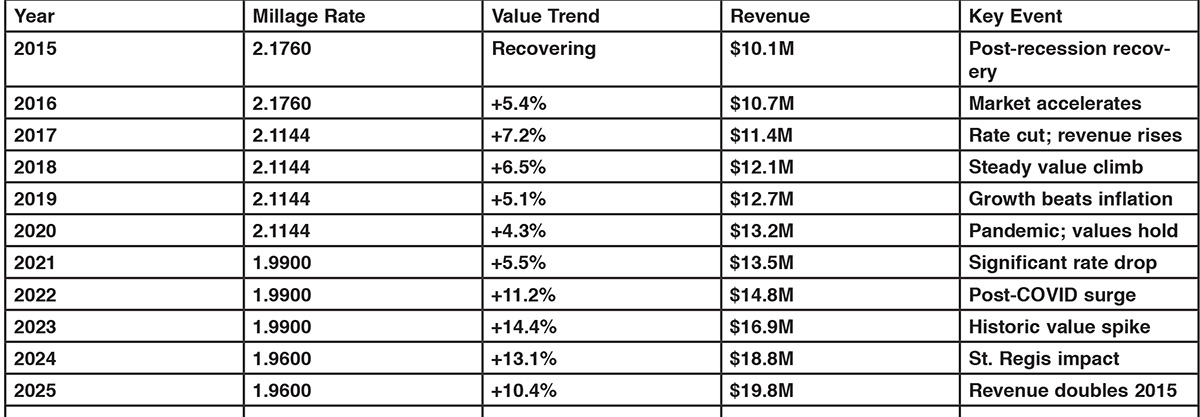

The following table tracks the Town of Longboat Key’s operating millage rate against the estimated property tax revenue collected.

Note: Revenue figures are rounded estimates based on adopted budgets and audited financial reports. “Millage” refers to the Town’s operating tax rate only.

The Town’s Defense: Why the Rate Stays Put

While the numbers show a windfall for the Town, officials argue that keeping the millage rate steady—rather than adopting the lower “rollback rate”—is a fiscal necessity.

In budget hearings, Town Manager Howard Tipton and the Commission have consistently defended the revenue increases by pointing to rising costs that outpace simple inflation.

• Public Safety: Police and fire services account for over half the budget. To retain staff in a high-cost region, the Town approved a 6.5% wage increase recently.

• The Hurricane “Safety Net”: Following Hurricanes Helene and Milton, the Town withdrew ~$8 million from reserves. Maintaining the tax rate is viewed as essential to replenish funds before the next storm.

• Inflation: Costs for insurance, fuel, and construction materials have soared for the Town just as they have for residents.

The “Rollback” Rate Explained

To understand why your taxes go up when the rate stays the same, you have to understand the “Rollback Rate.”

Under Florida law, the Rollback Rate is the millage rate the town would need to set to collect the exact same amount of money as the previous year, excluding new construction.

• Scenario A: Property values go up 10%. To keep your tax bill flat, the Town would need to lower the millage rate by roughly 10% (the Rollback Rate).

• Scenario B (Reality): The Town keeps the millage rate the same. Because applied to a higher value, the math results in a higher bill.

Technically, keeping the rate flat when values rise is considered a tax increase under Florida Truth-in-Millage (TRIM) laws because it generates more revenue than the rollback rate would.

The “St. Regis Effect”

Two major factors have hyper-charged this trend in the last three years: the COVID real estate boom (11-14% value jumps) and the completion of the massive St. Regis Resort. The St. Regis alone has added hundreds of millions in taxable value, responsible for a significant chunk of the new revenue in FY25.

The Homestead Factor & Pending Legislation

While the “flat rate” illusion hits second-home owners and investors—a massive demographic on Longboat Key—hardest, full-time residents have had a shield: the “Save Our Homes” cap. This limits the annual increase in assessed value for homesteaded properties to just 3% (or the CPI, whichever is lower), creating a two-tier tax system where your neighbor in an identical condo might pay double what you pay simply because they don’t have homestead status.

However, new and proposed legislation is shaking up this dynamic:

• Amendment 5 (The “Inflation Buffer”): Passed by voters in late 2024 and effective for the first time in this 2025 tax cycle, Amendment 5 now indexes the homestead exemption to inflation. With inflation remaining sticky, this provided a small but necessary buffer for residents this year.

• Radical Reform (2026 Session): Right now in Tallahassee, lawmakers are debating changes that could make the chart above obsolete. Proposals are circulating to potentially eliminate property taxes entirely in favor of a consumption-based model, or alternatively, to drastically increase the base exemption (proposals for a universal $100,000 exemption are currently in committee). If passed, these measures would force Longboat Key to completely restructure how it funds its $20 million+ annual budget.

• Immediate Hurricane Relief: For those impacted by Hurricanes Helene and Milton, relief is available now via Form DR-465. This legislation allows homeowners to request a tax refund for the days their property was “uninhabitable” (30 days or more). While this helps residents, town officials warn it could create an unexpected dip in collections for early 2026, potentially forcing a millage rate discussion next budget cycle.

The Bottom Line

Over the last decade, the Town of Longboat Key has successfully doubled its annual property tax haul—from roughly $10 million in 2015 to nearly $20 million in 2025.

For residents, the lesson is clear: The “unchanged” millage rate is a policy choice. It reflects a Town government that prioritizes building reserves, funding competitive wages, and insuring against disaster over lowering the annual tax burden. But with Tallahassee eyeing radical tax reform next year, this decade-long trend may soon face a sudden, legislative end.

Data Sources: Town of Longboat Key Annual Comprehensive Financial Reports (2015-2024), Town of Longboat Key Adopted Budgets (FY2021-FY2025), Sarasota & Manatee County Property Appraiser Data.

Interesting article! Even though the tax rate didn’t go up, the town still collected a lot more revenue because property values changed.

Town commissioners continue to feed at the trough.